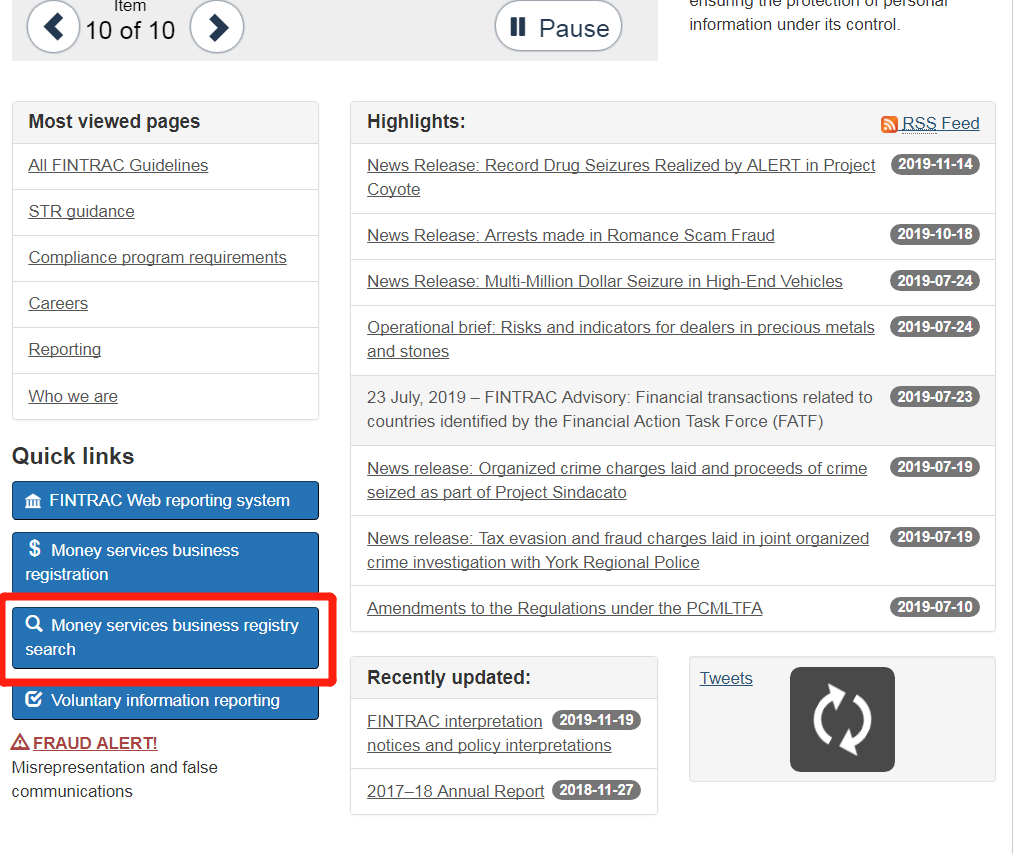

Company Registration

Hot Topics

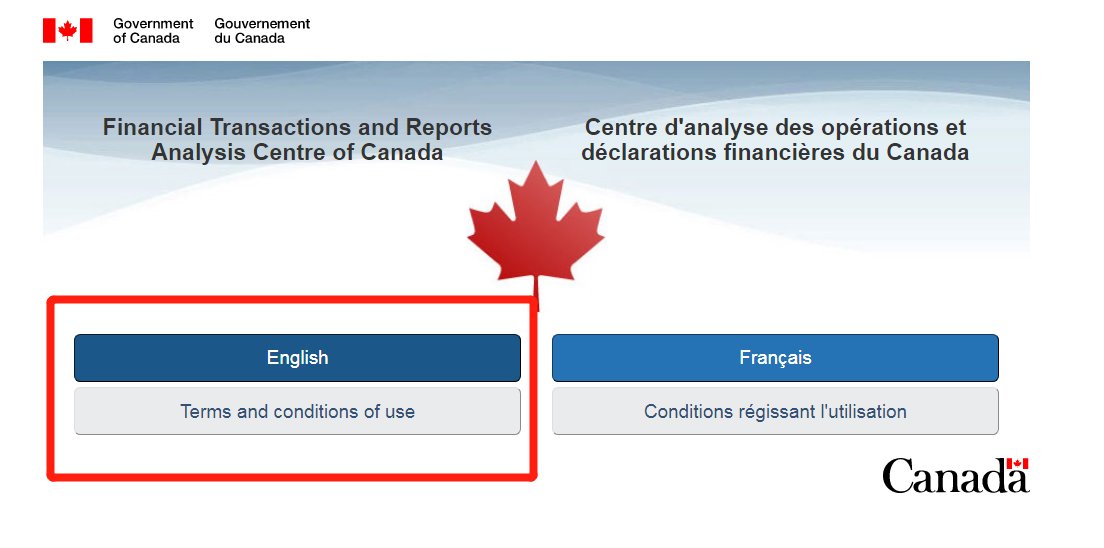

Forex License

Hot Topics